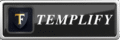

Airbnb Rental Property Management | Excel And Google Sheets | Rental Income and Expense Tracker

السعر الأصلي هو: $55.99.$24.99السعر الحالي هو: $24.99.

Real Estate🏡 Airbnb Income & Expense Spreadsheet for Hosts & Property Managers

📊 For Excel & Google Sheets

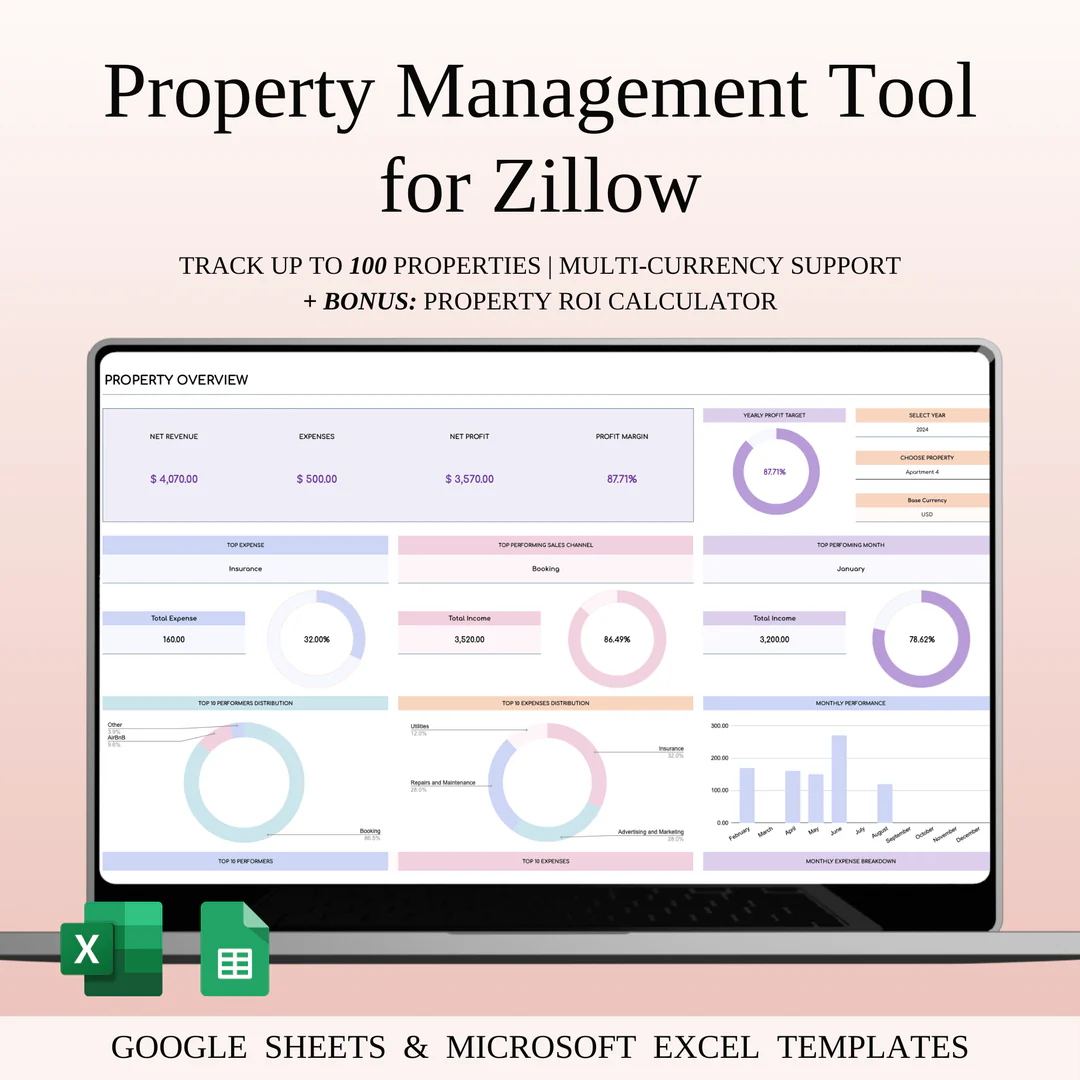

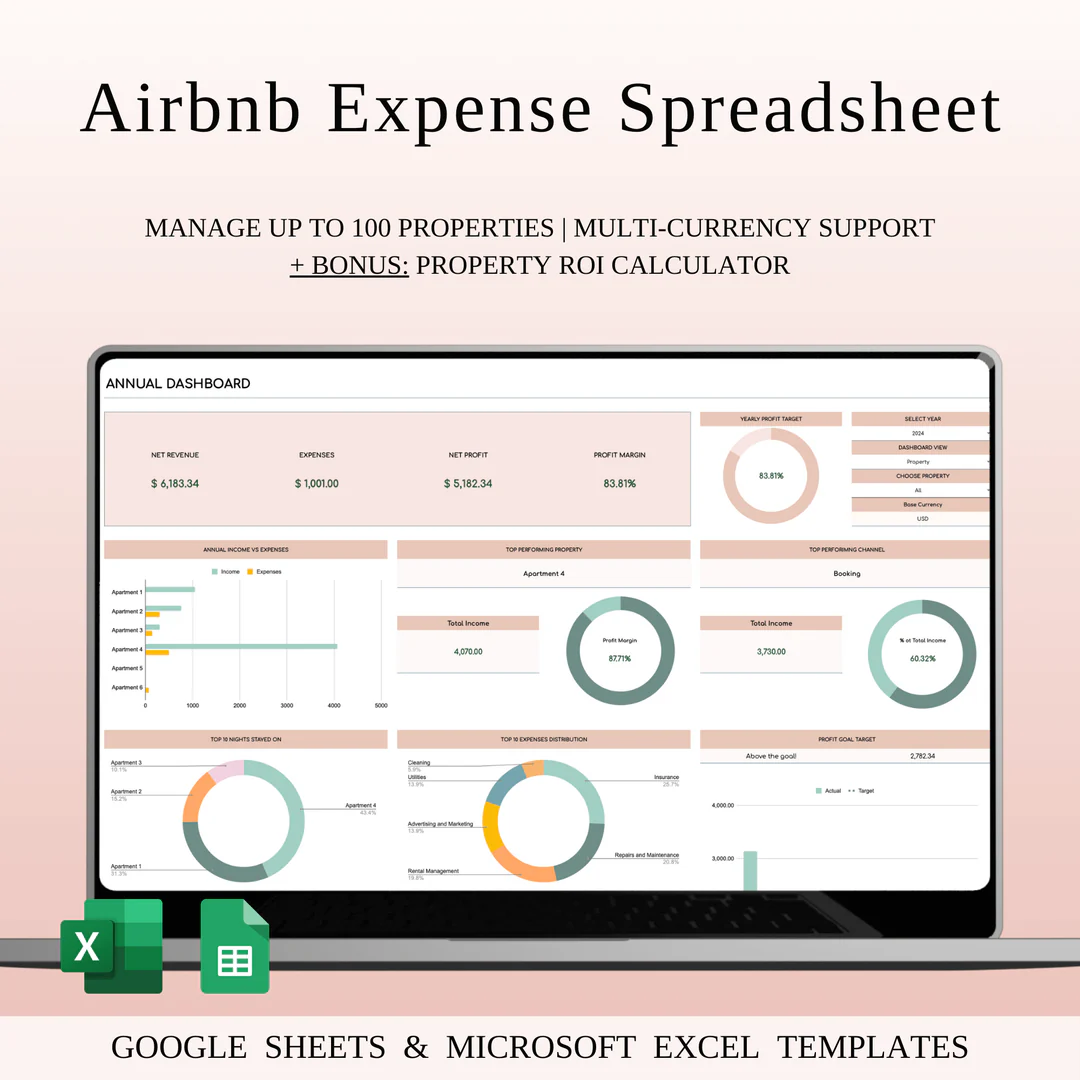

Maximize your rental profits with this all-in-one Airbnb Income & Expense Tracker! Designed for Airbnb hosts, property managers, and rental business owners, this spreadsheet helps you effortlessly track income, expenses, and property performance across multiple booking platforms like VRBO, Zillow, Booking.com, HomeAway, and TripAdvisor.

💡 Key Features:

✔ Multi-Property & Multi-Platform Support – Manage up to 100 properties across different rental platforms 📍

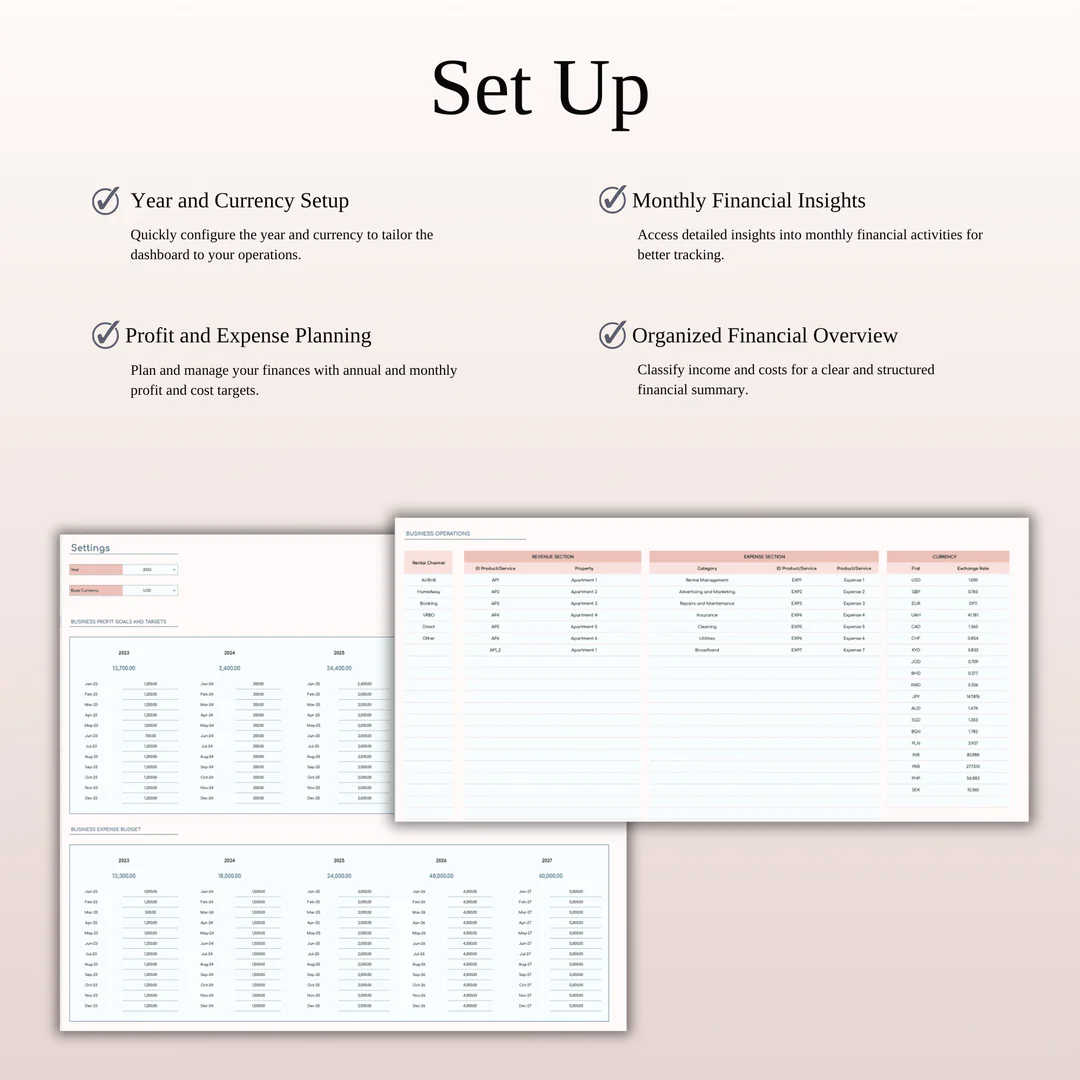

✔ Quick & Intuitive Setup – Just copy and paste your transaction data, and let the spreadsheet handle the calculations ⚡

✔ Automatic Booking Summaries – Get a clear snapshot of each property’s performance 📋

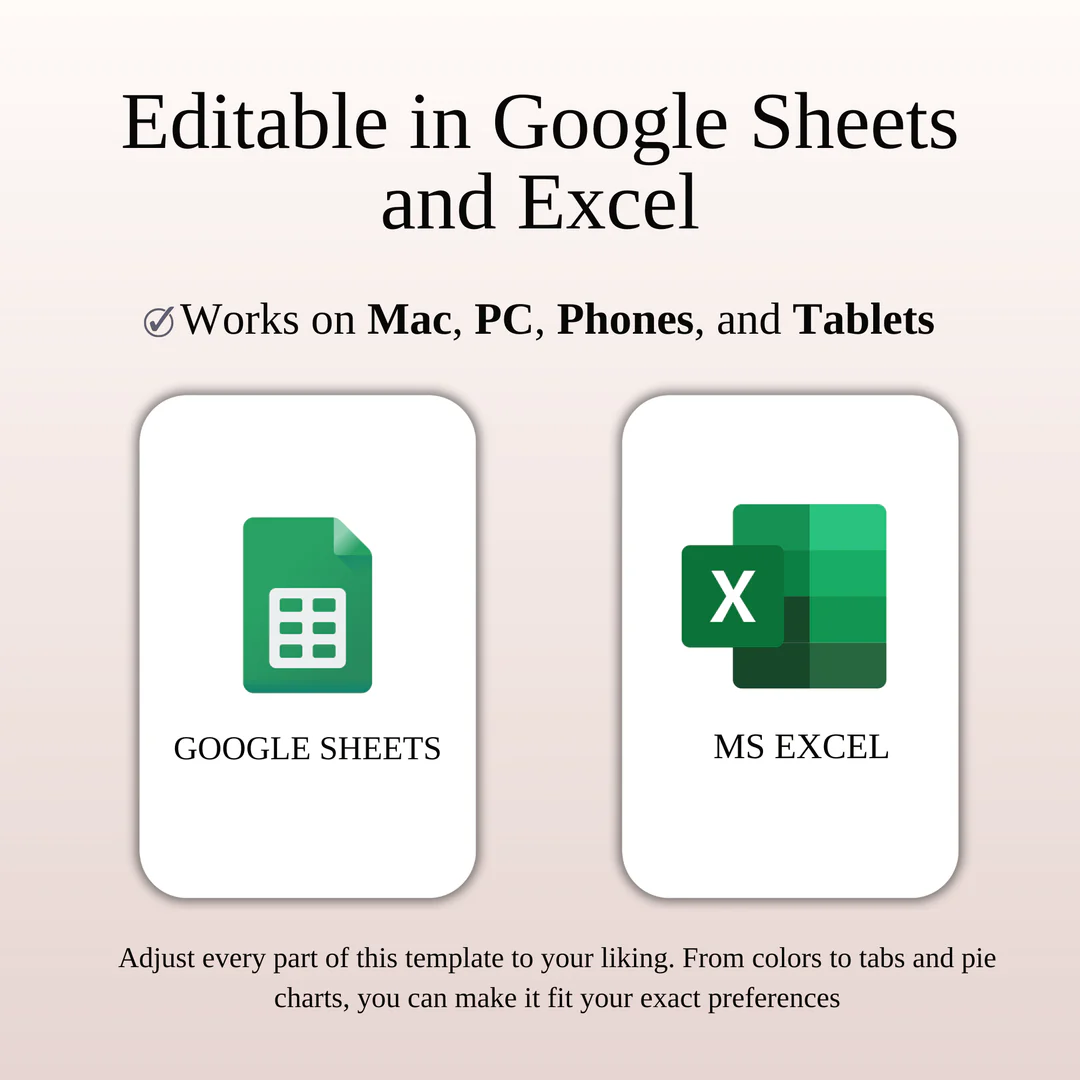

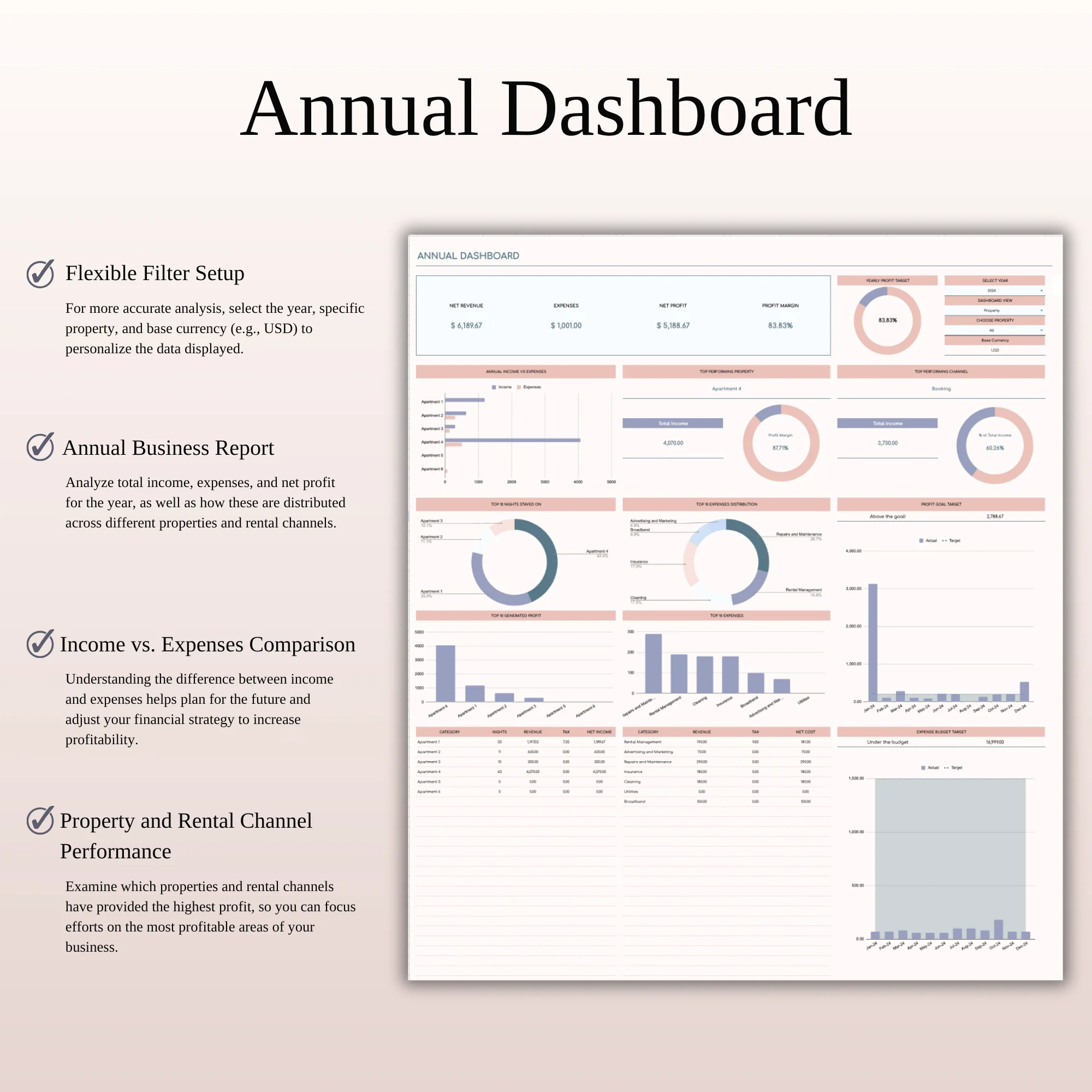

✔ 5-Year Projections & Forecasting – Plan your long-term rental business strategy 📈

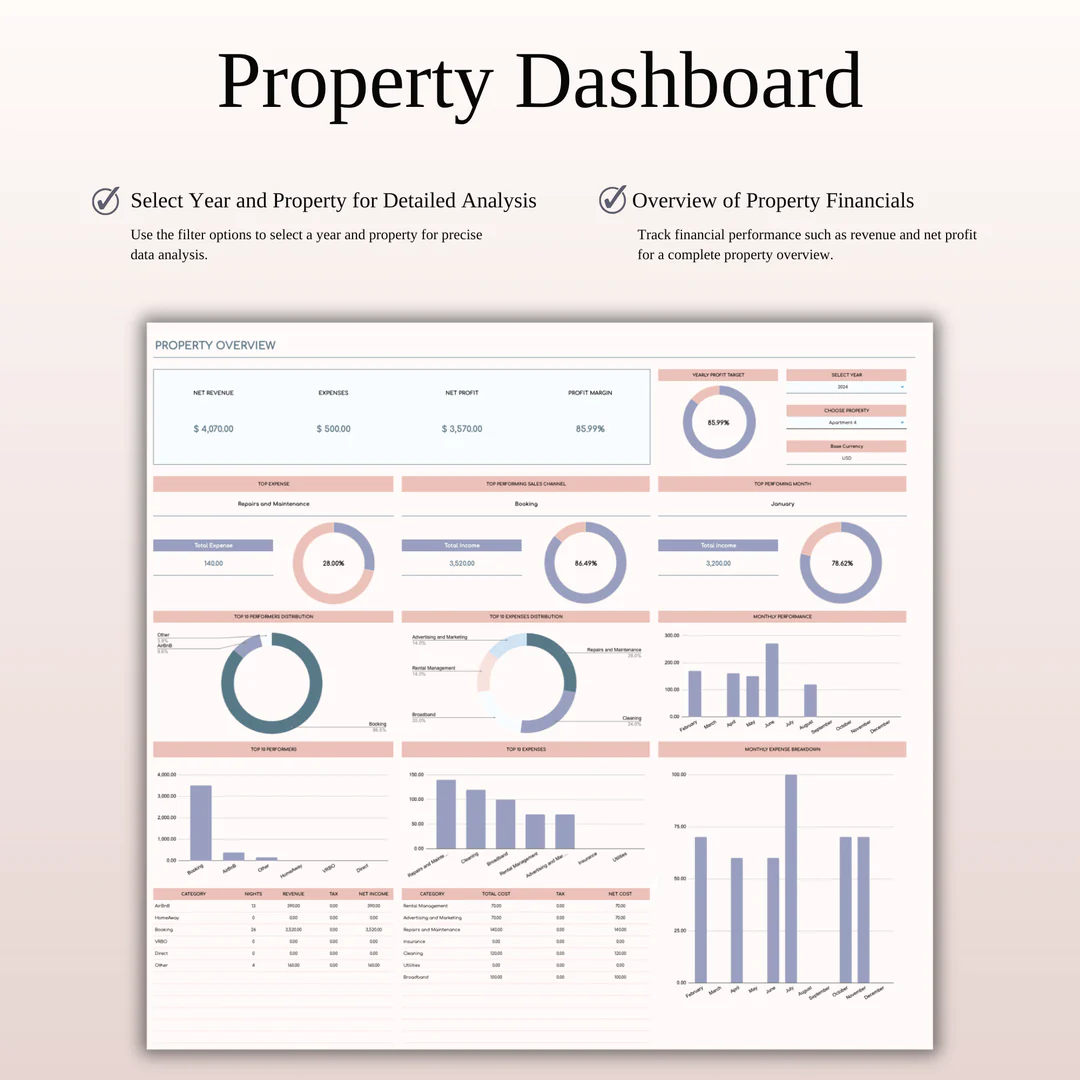

✔ Advanced Analytics & Reports – Track profitability, expenses, and financial performance with ease 🔍

✔ ROI Property Management Calculator – Evaluate investment returns for each rental property 🏠

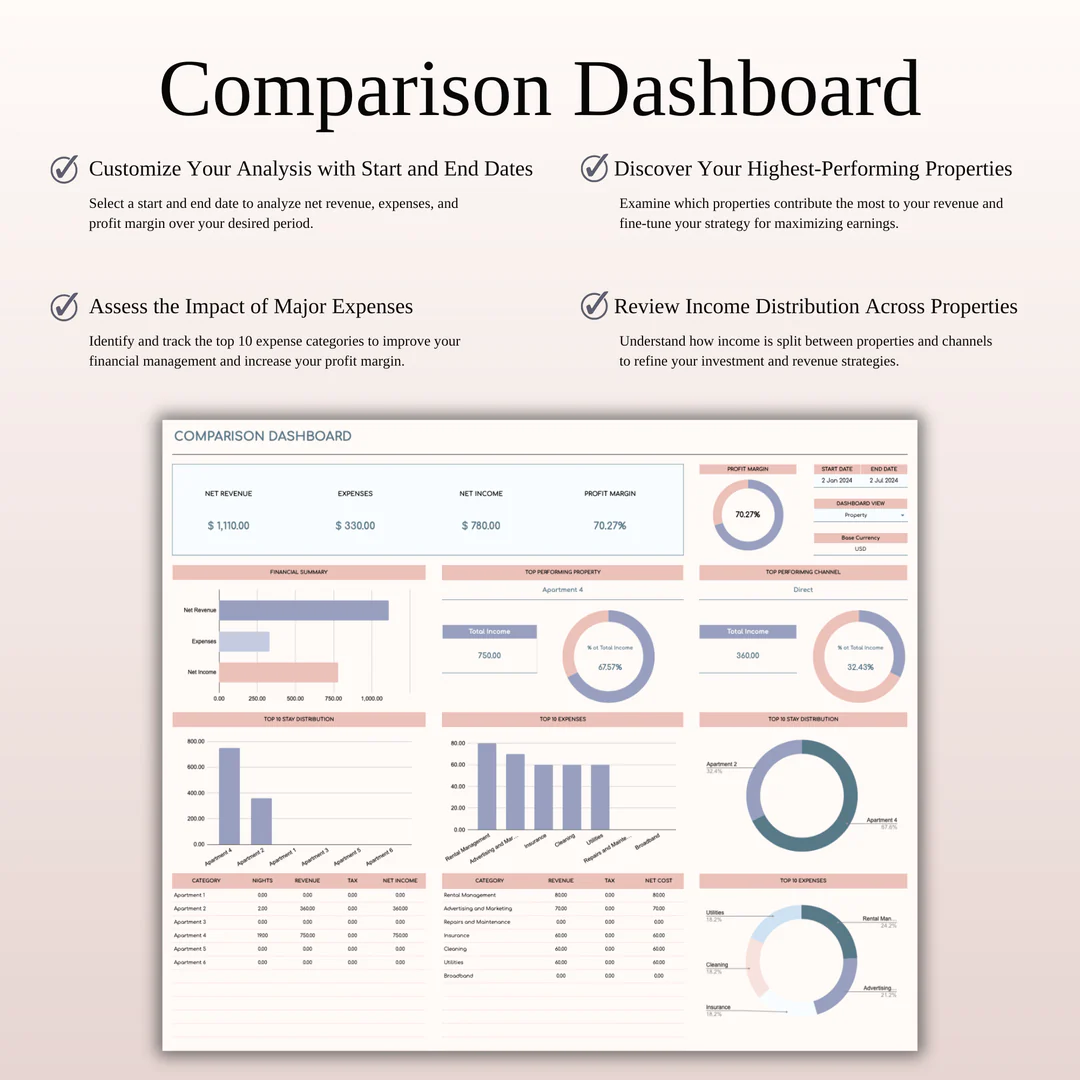

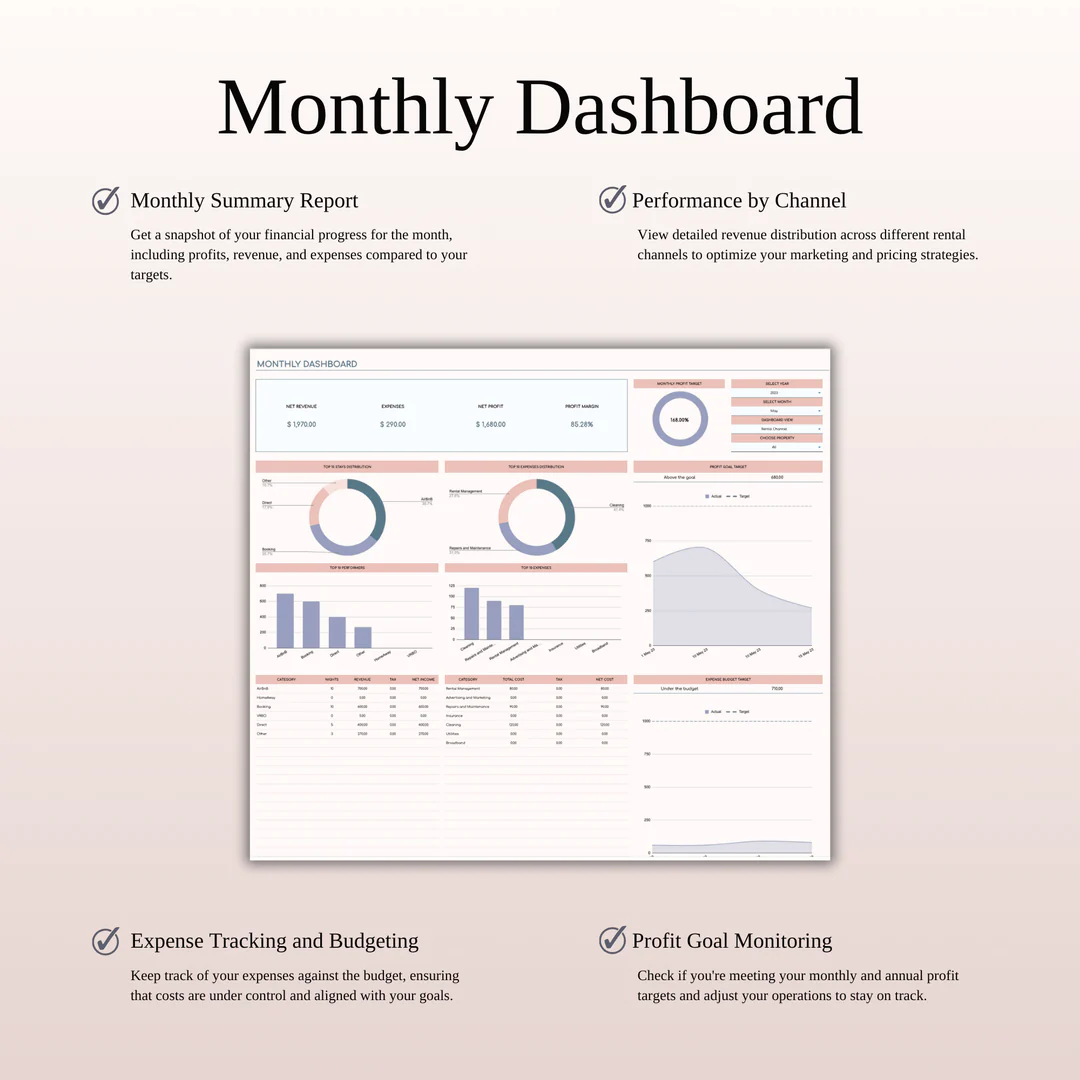

✔ Custom Dashboards – Get insights with monthly, annual, and comparison dashboards 📊

✔ Expense & Budget Tracking – Stay on top of your rental expenses and financial goals 💰

✔ Top-Performing Properties Analysis – Identify which listings generate the most profit 🎯

📌 Who Is This Template For?

✅ Airbnb Hosts & Short-Term Rental Owners – Track revenue, expenses, and guest payments effortlessly.

✅ Property Managers – Monitor multiple properties, compare performance, and streamline operations.

✅ Real Estate Investors – Optimize rental income and maximize ROI with detailed financial tracking.

📥 Gain full control of your Airbnb business today! Get detailed financial insights, streamline expense tracking, and boost profitability. 🚀

يجب عليك تسجيل الدخول لنشر مراجعة.

المراجعات

لا توجد مراجعات بعد.